How FinanceMutualTM Strengthens Your Business

Are You Tired of Losing Customers Over Price?

-

The Hesitation: High upfront costs make customers pause, even when they need your service.

-

The Lost Sale: "I need to think about it" becomes a lost deal for your business.

-

The Ripple Effect: One lost sale means lost referrals, lost repeat business, and lost momentum.

Empower Every Customer to Say 'YES' Today.

-

Remove the Price Barrier: Instantly offer flexible, affordable monthly payment plans.

-

Close the Deal: Convert hesitant buyers into happy customers on the spot.

-

Automate Your Revenue: We handle the entire billing and collection process for you.

-

Win-Win: Your customer gets the service they need, and you secure the sale without the hassle.

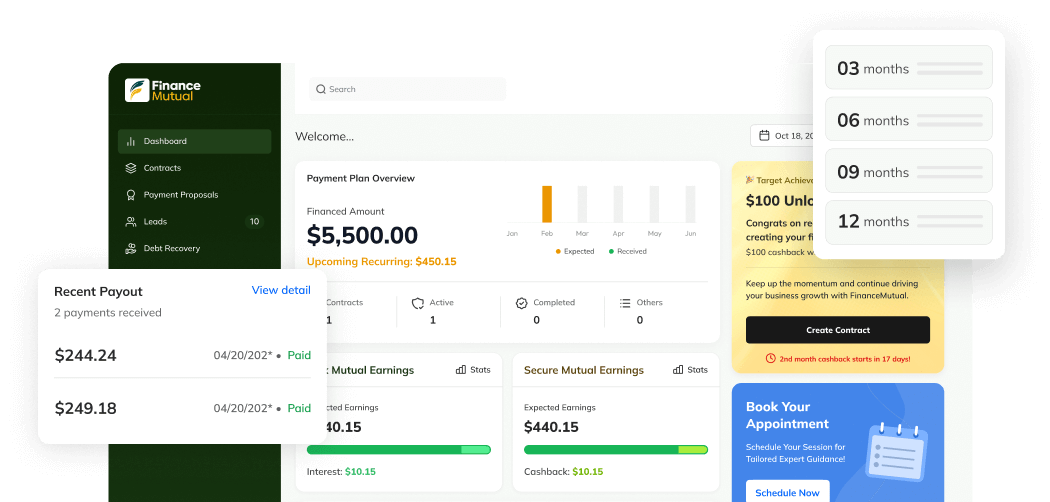

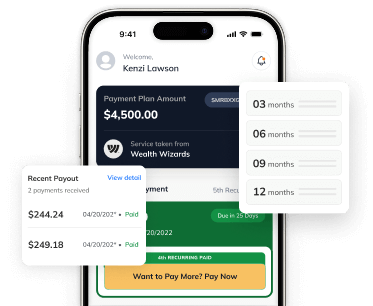

Our 3-Step Process

Step 1: Generate a Plan

Enter the service total into the FinanceMutualTMplatform on your computer or tablet. Instantly see several friendly monthly payment options tailored to the customer’s past payment behavior.

Step 2: Customer Applies in Minutes

Your customer selects their preferred plan and completes a simple, fast application right there with you. We run a quick soft credit check that won't affect their score, and approvals are near-instant.

Step 3: Automate Your Payments

Once approved, we manage the customer's payment plan and deposit funds into your account every month as they're paid. It's reliable revenue that boosts your cash flow.

Grow Your Business, Not Your Worries.

Increase Your Revenue by up to 40%

By removing the hurdle of upfront costs, you make your services accessible to everyone. More options for customers mean more revenue for you.

Automate Billing & Get Paid Reliably

Stop wasting time chasing invoices. We handle the entire monthly collection process for you, ensuring predictable revenue lands in your bank account without the administrative headache.

Build Unbeatable Customer Loyalty

Become the go-to business that works with your customers. Offering payment flexibility builds immense trust and ensures they come back to you for future needs—and refer their friends.

Eliminate Risk & Hassle

We take on the risk of customer non-payment and manage all the collections paperwork and follow-up, so you can focus on what you do best: running your business.

Ready to See It in Action?

A 10-minute discovery call is all it takes to see how FinanceMutual™ can be tailored to your business. No pressure, no commitment. Just a clear path to stronger business and happier customers.